Best startups of the decade | Indian startups (2010-2020)

The Startup India campaign is a beacon of hope and opportunity in India’s dynamic startup landscape. Launched in 2016 by the Indian government, its visionary mission aims to stimulate innovation and promote entrepreneurship on a grand scale.

This initiative has propelled Indian startups to remarkable heights in the tech industry, with many achieving the esteemed “unicorn” status, signifying privately held startups valued at over $1 billion.

At the core of this program lies the concept of an ‘Eligible Startup,’ a term with profound significance in the entrepreneurial realm. Being an ‘Eligible Startup’ isn’t just a label; it’s a golden ticket to a world of tax benefits and exemptions.

It signifies a company that meets specific criteria, including its age, nature, and potential for innovation and job creation. Understanding the requirements to become an ‘Eligible Startup’ is the initial step towards accessing a treasure trove of opportunities within India’s vibrant startup ecosystem.

Eligibility Criteria for Startup India

India’s startup scene is booming, with government support through initiatives like Startup India. To qualify as an ‘Eligible Startup,’ certain criteria must be met:

1. Be a DPIIT-recognized startup, requiring registration with the Department for Promotion of Industry and Internal Trade (DPIIT).

2. Operate as a private limited company or limited liability partnership for a formal, legally recognized business structure.

3. Maintain an annual turnover below Rs. 100 crore, targeting small and medium-sized enterprises.

The Indian startup ecosystem is on the brink of transformation through a significant amendment to Section 79 of the Income Tax Act of 1961, proposed in the Union Budget 2023. This change aims to extend the duration during which eligible startups can carry forward and offset losses incurred in their initial ten years, offering greater financial flexibility and resilience in the early years of operation.

Tax Exemptions for Eligible Startups in India

India’s startup ecosystem is thriving, and the government has introduced initiatives to support it. One such initiative is the Startup India campaign, offering benefits to eligible startups.

Under the Startup India Program, eligible startups receive the following tax exemptions:

1. Three-year tax holiday in a block of seven years: Startups incorporated between April 1, 2016, and March 31, 2023, can enjoy a 100% tax rebate on profit for three years in a block of seven years, provided their annual turnover does not exceed Rs. 25 crores in any financial year.

2. Exemption from tax on long-term capital gains: Eligible startups can exempt their tax on long-term capital gains by investing a portion in a government-notified fund within six months of asset transfer.

3. Tax exemption on investments above the fair market value: The government exempts tax on investments above the fair market value in eligible startups.

These exemptions aim to support and encourage startup growth in India. Anticipated updates from Budget 2023 are expected to provide further incentives for startups to thrive and contribute to India’s economic growth.

Angel Tax Exemption – only for Startups in India

The article titled “Angel Tax Exemption: A Game-Changer for Startups in India” on TaxGuru¹ discusses the recent tax laws in India and their impact on the startup ecosystem, emphasizing the importance of angel tax exemption.

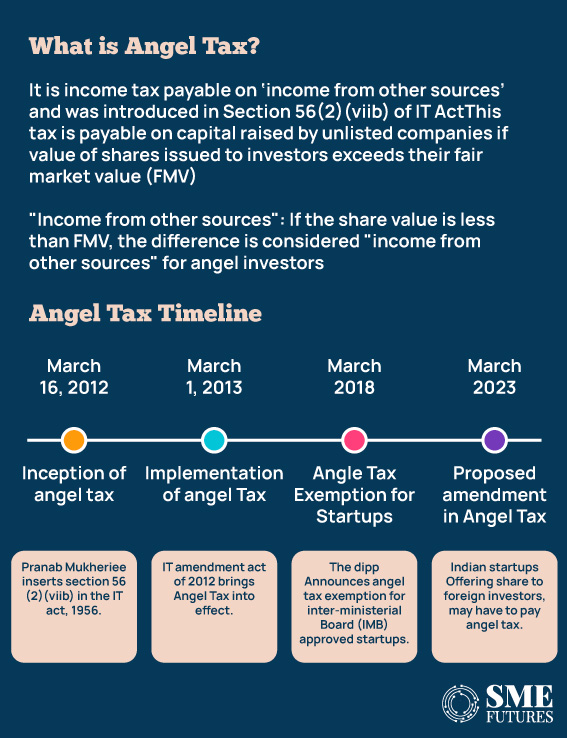

Angel tax, also known as Section 56 (2) (viib) of the Income Tax Act, has been a longstanding problem for startups in India. Earlier, when startups received funding exceeding their fair market value, the surplus was considered income and taxed, causing significant burdens and hindrances for startups, impeding their growth and investment prospects.

To create a more startup-friendly environment, the Indian government has taken action to offer relief and exemption from angel tax. These changes were introduced through amendments to the Finance Act and the issuance of Notification No. GSR 127 (E) dated February 19, 2019.

Eligibility criteria for startups for Angel Tax Exemption

The eligibility criteria for startups to qualify for angel tax exemption in India are as follows:

1. Startups must register under the Companies Act of 2013.

2. They should have been incorporated for less than 10 years.

3. Their annual turnover should not exceed INR 100 crore in any previous year.

To seek angel tax exemption, startups must:

1. Obtain a certified valuation from a SEBI-registered merchant banker.

2. Submit this valuation and other required documents to the CBDT for assessment.

Recent changes in the angel tax exemption also benefit angel investors. The requirement for investors to ensure that their net worth exceeds the investment amount has been removed.

The introduction of angel tax exemption brings several benefits to the Indian startup ecosystem, including:

1. Encouraging investments

2. Boosting entrepreneurial spirit

3. Simplifying compliance

The exemption eases the burden on startups and incentivizes angel investors to provide more capital to early-stage ventures. It eliminates the fear of taxation, instilling confidence among entrepreneurs. The revised tax laws also streamline the process of availing angel tax exemption.

Impact of the New Tax Laws for Startups in India

The new tax laws in India, effective from April 1, 2023, will bring significant changes to the country’s financial landscape. These changes will affect all taxpayers.

The most important change is the introduction of a new income tax regime, which will be the default option for taxpayers. However, individuals can still choose the old regime if they prefer.

The new tax regime changes the income tax slabs, giving relief to low and middle-income earners. Income up to ₹3,00,000 will now be tax-exempt, and higher income brackets will face a progressive tax rate, reducing the burden on many taxpayers.

Section 87A

Another substantial change is the increase in the rebate under section 87A, which allows taxpayers with incomes up to ₹7 lakhs to avoid paying any taxes. This expanded threshold is a significant improvement from the previous limit and is expected to benefit a substantial portion of taxpayers.

Furthermore, the new tax laws extend the standard deduction of ₹50,000 from the old regime to the new one. This is particularly advantageous for salaried employees and pensioners who choose to follow the new tax regime.

Additionally, the highest surcharge rate has been reduced from 37% to 25% in the new tax regime. This reduction will bring relief to high-income taxpayers with earnings exceeding ₹5 crore.

The new tax laws of 2023 in India promise substantial changes to the taxation system. While they aim to simplify the tax structure and provide relief for many, the actual impact on individual financial situations will vary. It is imperative for taxpayers to carefully review these changes and plan their finances accordingly to optimize their tax liabilities under the new regime. These revisions mark a significant shift in India’s tax landscape, offering both opportunities and challenges for taxpayers of all income levels.

Conclusion

Indian startups have come a long way; their innovative ideas and solutions have attracted investors from all over the world. Additionally, the success stories of Paytm, Zomato, Byju’s, Ola, and Flipkart have inspired a whole new generation of entrepreneurs in India, making the phrase “unicorn” a household term. Given India’s thriving startup ecosystem, we can expect many more Indian startups to achieve unicorn status in the coming years. If you want to become the next unicorn startup in India, contact us.

by Surya.